Cut Out Jargon Using the Plain Language App

Meet Sarah, a Content Specialist at a major bank. She crafts a range of customer-facing materials—loan agreements, credit card terms, and FAQs. Clients often complain about puzzling financial terminology. With the “Simplify copy” feature in the Plain Language App, Sarah eliminates jargon that overwhelms everyday customers.

The Challenge: Making Financial Terms Accessible to All

Sarah was tasked with updating the bank’s loan agreement templates. The documents needed to:

- Replace complex financial jargon with plain language.

- Ensure legal accuracy while enhancing readability.

- Maintain a professional tone suitable for diverse customer backgrounds.

How the Plain Language App Removes Financial Gobbledygook

Step 1: Submit the Jargon-Laden Text

Sarah accessed Microsoft Teams and clicked on "View Prompts." She then selected Simplify copy, which pre-populated the prompt:

Simplify copy

Sarah must then paste or type the content requiring simplification into the prompt. Below is an example of content that needs simplifying:

Pursuant to the financial institution's regulatory and procedural framework, it is incumbent upon all individuals engaged in credit arrangements to adhere unequivocally to the repayment schedule as delineated within the contractual terms. Such schedules encompass the principal loan amount, compounded interest obligations, and ancillary fees, which remain subject to recalibration predicated upon dynamic macroeconomic indicators and prevailing financial conditions.

Any deviation from the prescribed repayment obligations shall necessitate the procurement of prior explicit authorization from the designated financial overseer, contingent upon the provision of substantial and verifiable documentation justifying said deviation under extraordinary circumstances. Such authorizations are evaluated stringently to ensure compliance with fiduciary responsibilities and the institution's broader risk management protocols.

The overarching intention of these stipulations is to fortify the institution's fiscal solvency and operational integrity while simultaneously upholding adherence to statutory and regulatory mandates. This safeguards the interests of all pertinent stakeholders, including but not limited to depositors, shareholders, and ancillary beneficiaries of the institution’s services.

Step 2: Request a Plain-Language Conversion

To ensure clarity, Sarah followed up with:

Can you adjust this text to ensure it sounds more formal and trustworthy, emphasizing the institution’s professionalism while remaining clear and understandable?

Step 3: Evaluate the Tone and Professionalism

Once the text was simplified, Sarah asked:

Does this text meet the standards of professionalism and clarity required for customer-facing communications? Please answer in a single sentence or yes/no.

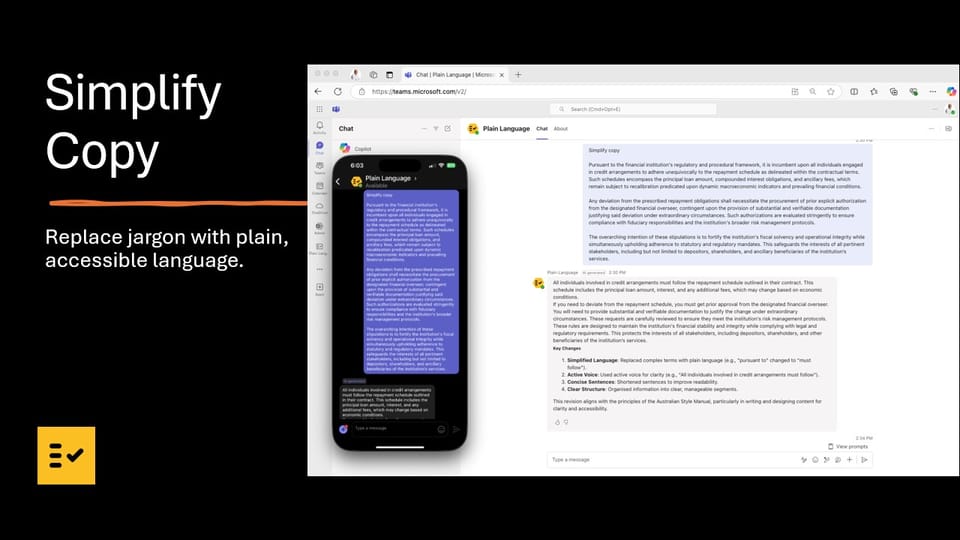

Watch the 'Simplify copy' prompt in action:

Why This Matters

By using the Plain Language App, Sarah:

- Avoids alienating customers with complex terminology.

- Promotes transparency and trust in financial services.

- Creates documentation that balances clarity with compliance needs.

Try the Plain Language App Today!

Ready to make your financial documents more inviting? The Plain Language App turns complicated text into approachable content—give it a try!